Used car prices are falling, but buying is still a challenge for many people. Higher interest rates are the main culprit in raising monthly payment amounts. If you recently bought a car, you may have benefited from the drop in prices. Or, if you paid a higher price earlier in the year, you probably benefited from lower interest rates.

Historic Used Car Prices Evening Out

Most of this year and last year saw record increases in prices for used cars. They haven’t quite deflated into the great deal territory, but they have dropped by about 4% in recent weeks. This drop is more likely to benefit used car shoppers who are paying with cash. If you have to finance, the rising interest rates will probably negate this price drop.

However, not everyone can wait for a better economic outlook if they want a new car. If you’re looking at used cars, the top tip is to act quickly on a good deal and negotiate with an informed outlook. If you have cash, you’re already ahead of the game. However, if your credit score is very good, you can still get a competitive rate.

Look for an Older Used Car

One good tip for those paying for used cars with cash is to look at older models. Prices on older used cars have dropped the fastest. Used cars that are only a few years old are still likely to cost almost as much as new cars. Look at older models known for reliability. For example, some usual suspects for long-term reliability are the Toyota Camry and Honda Accord.

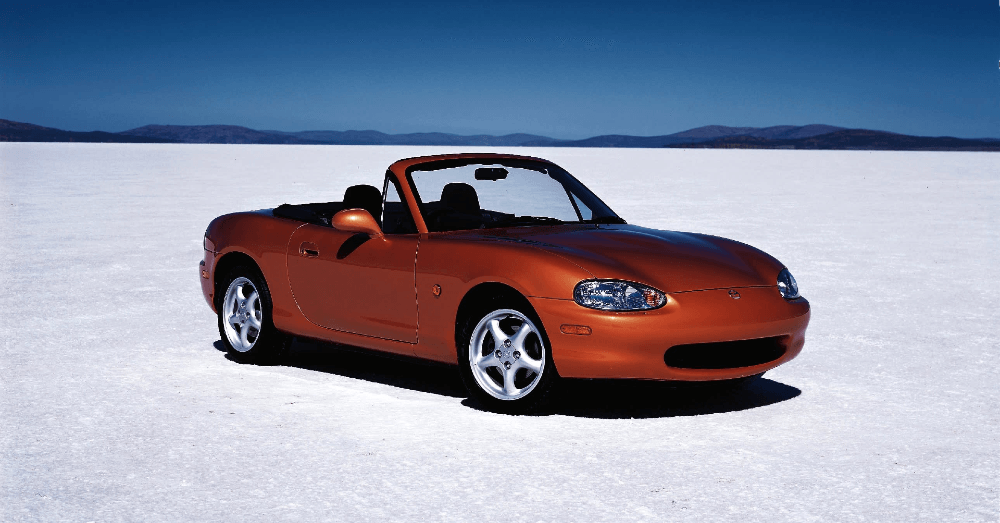

However, some of the best candidates for strong reliability and affordability for older models are sports cars. The Chevrolet Corvette, the Mazda MX-5 Miata, and the BMW Z3 and Z4 models are all good examples of this. There are two big factors that help these models stay running longer–strong powertrains and owners that take care of them. Older trucks also tend to be long-lasting and affordable.

Buy Out Your Lease

Another way to secure your used car is to buy back your lease. If you’re currently in a lease and are reaching the end, you might consider buying it back. This mainly applies to consumers who signed a lease before the prices for used cars started soaring, which would have been prior to early 2021. This means that your lease’s future value was likely put well below the current market prices. In other words, you can potentially buy your leased vehicle for a lot less than you would pay if you tried to buy it from a dealer at current prices. If you bought at the height of the market, you probably won’t recoup that money in the future. Experts expect the car market to flatten out eventually, but even cars bought at inflated prices will depreciate.

This post may contain affiliate links. Meaning a commission is given should you decide to make a purchase through these links, at no cost to you. All products shown are researched and tested to give an accurate review for you.